The check

It is a commercial paper, as it is mostly used in commercial transactions, and it is an alternative to money, as it facilitates dealings between people. The person may not carry money all the time, then he writes the check in favor of the other party, which is disbursed by the bank under the account of the person writing the check. Banks have facilitated this issue, so any person who has a current account in any of the banks is given a check book. According to certain conditions, this person only has to fill in the empty boxes, sign the check, and deliver it to the other party. The person may have to write the check himself, if he does not have a checkbook, so how can that be?

How to write a check

In order to know how a check is written, we must first talk about its validity and its legal impact on the person, then after that its contents, and the mechanism for writing it, and the details are as follows:

Validity of the check and its legal effect

A check written by a person himself (office check) does not differ in legal validity from a check issued by a bank (bank check). Most countries have stipulated the validity of the check and its legal effect within the provisions of their commercial law, and did not differentiate between an office check and a bank check. Because a check is required to have special conditions in order to be considered legally binding, and these conditions lie in its contents. When those contents are available in the bank or office check, it will be considered binding by law, and has its legal effect. In the event that the balance is not present in the account, the person will be prosecuted for the crime of issuing a check without account.

Read also:Essay on free time topicContents of the check

- word check; So that it is written on the body of the paper, and in the same language in which the paper was written.

- The check is not subject to a condition; It is a paper that means paying a certain amount, without any conditions.

- The name of the drawee; It is the bank.

- Check date.

- Drawer's signature; (The person who wrote the check).

The presence of these above-mentioned contents in doubt is necessary; So that it is binding on the person drawing, and has its authority, and can be pursued through the courts if necessary. As for the other contents, they are not binding, and their absence is not considered to affect the authenticity of the check.

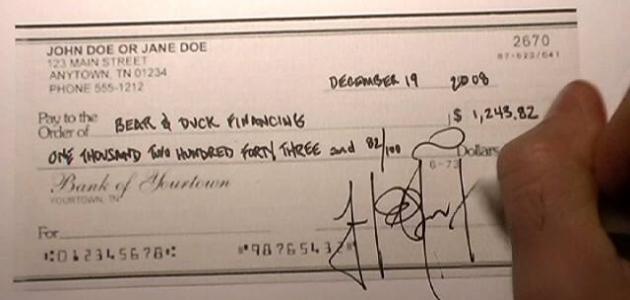

Check writing mechanism

- Start by writing the phrase: Pay by this check.

- Writing the name of the person to whom it is drawn, who is the beneficiary, to whom the amount will be paid, saying: To the order of the master (and writing the name of the person to whom it is drawn).

- Write the amount required to be paid to the drawee; It is recorded in numbers and in writing.

- Write the name and signature of the person drawing.

- Write the name of the drawee, which is the bank.

- Writing the date, and some people write a distant date believing that the check will not be paid except on its date, but the bank will withhold the amount as soon as the check is presented to it, and it will not adhere to the date even if it is distant. The issue of the date is an issue created by custom in commercial transactions, and it is not binding. For banks.